John Hyre’s Horrifyingly Detailed Entities Class – Now Online!

Brace yourself for Eight Days of mind-blowing, no-nonsense, asset-protecting, tax-saving mastery with John Hyre. For years, real estate investors and savvy entrepreneurs (yes, even the “normie” ones like dentists and plumbers) have been begging for his in-depth, hands-on master class to be available online. Well, here it is, and it’s nothing short of horrifyingly detailed.

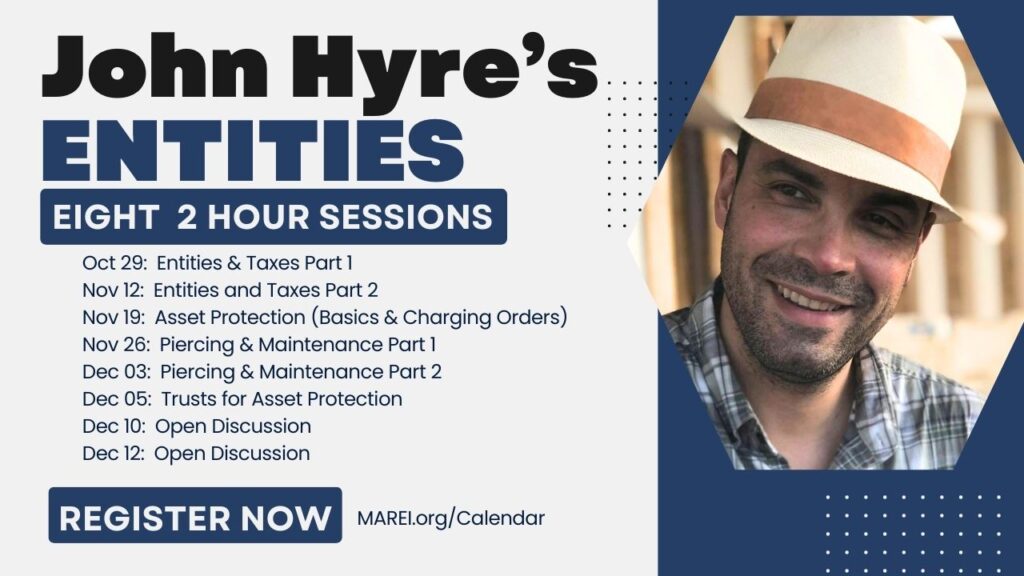

Eight 2-Hour Zoom Sessions. Live. Recorded. Interactive. Bring your toughest questions, and expect no fluff, no filler—just actionable strategies to save you a fortune.

Class Breakdown & Topics That’ll Make or Break Your Business

🔍 Non-Entity Asset Protection

- We’re talking lawsuit prevention, how to win if sued, and ensuring insurance pays when needed. These insights alone will put you way ahead of the pack.

🏢 Choosing the Right Entity (LLC, S-Corp, C-Corp, LP, Series LLC, Land Trust?)

- Save millions (yes, millions) in taxes by choosing the right entity for your business. The wrong one? It’ll cost you. John dives into the WHY so you can think for yourself when those “asset protection gurus” come knocking.

🌍 Where to Set Up Your Entity

- Nevada? Delaware? Wyoming? Home state? Get the cold, hard truth on where and why. Spoiler: “Popular” doesn’t always mean “smart.”

💼 Holding & Management Companies: Useful or Useless?

- Separate fact from hype. Holding companies shouldn’t pay bills for other entities. Management companies are often oversold and can create a lot of work for little benefit. We’ll break down when they do (and don’t) make sense.

📊 Keeping it Simple (When to Add Entities)

- More entities don’t mean more protection. Should each property have its own LLC? Generally not—and John’s going to explain exactly why.

🚨 Piercing the Corporate Veil & Maintaining Entities

- Over 80% of small businesses mess this up. Make sure you’re not one of them. Get John’s laser-focused tips on keeping your entities legally sound.

🏛️ Tax-Saving Myths & Facts

- When do C-Corps and S-Corps make sense (and when do they not)? Stop running your S-Corp like a tax time-bomb. And yes, we’ll even touch on ROBS (Rollover Business Startups) and how they’re making millionaires.

💀 Dangerous “Shortcuts” (Inter-Company Loans, Series LLCs, Equity Stripping)

- These can backfire horribly if done wrong. John tells it like it is so you don’t end up paying for bad advice.

Schedule That Demands Your Attention (And Yes, All Classes Are Recorded)

- Session I: Choice of Entity & Taxes (Part I) – Tues, Oct 29, 6 pm CST

- Session II: Choice of Entity & Taxes (Part II) – Tues, Nov 12, 6 pm CST

- Session III: Asset Protection Basics & Charging Orders – Tues, Nov 19, 6 pm CST

- Session IV & V: Piercing the Veil & Entity Maintenance – Nov 26 & Dec 3, 6 pm CST

- Session VI: Foreign & Domestic Asset Protection Trusts – Thurs, Dec 5, 6 pm CST

- Session VII & VIII: Q&A & Open Discussion – Dec 10 & Dec 12, 6 pm CST

Ready to Join? Here’s the Deal

Cost: $1,497 for all eight mind-blowing sessions. BUT because MAREI has partnered with a few other REIAs, we have access to a super special link that offers a discount and get’s you in for just $997!!

Want to Sign Up? Here’s Our Link (And yes, we do get a small referral fee because we know a good deal when we see one!) John is the real deal. If you need help with saving big money on your taxes and taking the best steps you can to protect the assets you have from others, this is the class you will want to attend.

When you check out, be sure to tell them you are with MAREI from KC so you get the discount!!