April 23, 2025 Press Release

April 23, 2025

Jackson County, Missouri

FOR IMMEDIATE RELEASE

Legislator Smith Continues to Fight for Jackson County Taxpayers

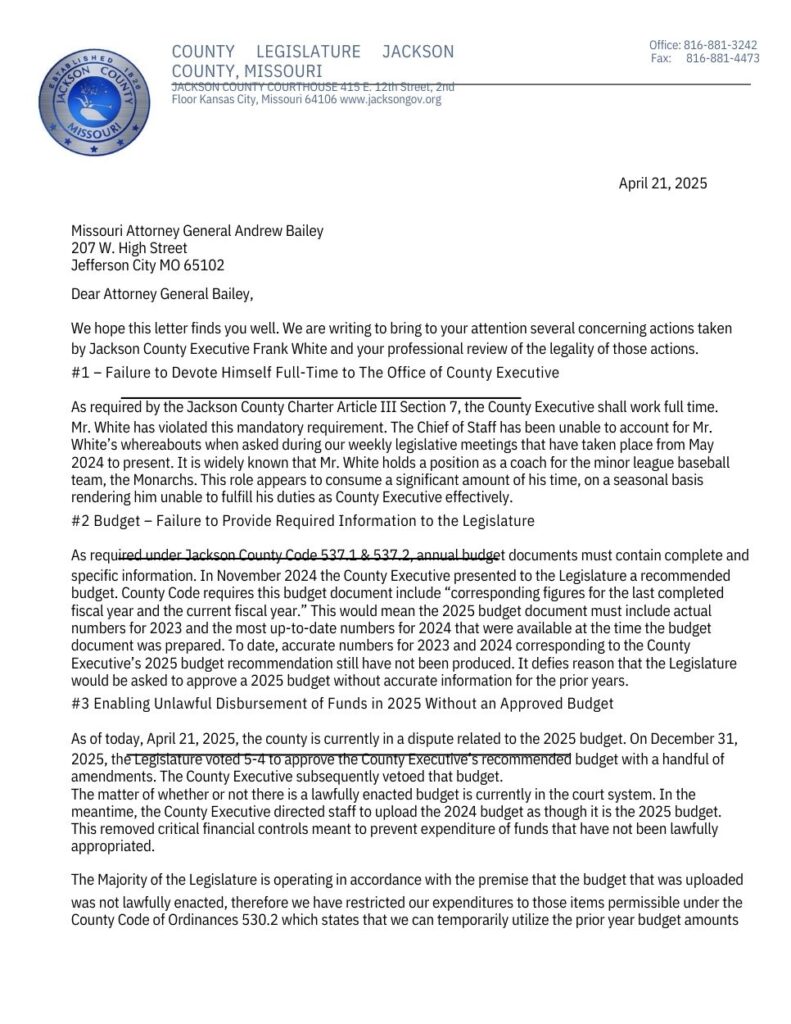

On Monday, April 21st Legislator Smith, Legislator Abarca, and Legislator Huskey sent the attached open

letter to Missouri Attorney General Andrew Bailey. The legislators are calling on the state and the authority within the Attorney General’s office to investigate the legality of recent actions of County

Executive Frank White.

Sean Smith says that after the recent veto of Ordinance 5958 that supported that

Missouri State Tax Commission’s Rollback Order, he is ready to call on the state for continued investigations.

At 3:30 PM on Wednesday, April 23 rd Smith will join community volunteers to turn in thousands of additional resident signatures for the Recall Frank White Petition. Smith will be at the Jackson County Election Board at 215 N Liberty Street in Independence Missouri and be available for comments and questions.

Copy of the Letter Sent

The Back Story

Background: 2023 Reassessments and State Audit

In 2023, Jackson County conducted a property reassessment that led to significant increases in property values—averaging around 30%, with some exceeding 100%. Missouri law mandates that any assessment increase over 15% requires a physical inspection and proper notification to the property owner. However, a preliminary audit by Missouri State Auditor Scott Fitzpatrick found that the county failed to comply with these requirements. Up to 200,000 homeowners were affected by inadequate notifications and the absence of required inspections, leading to potential overbilling .

Legal Actions and State Tax Commission Orders

In response to the audit findings, the Missouri State Tax Commission (STC) ordered Jackson County to roll back the 2023 assessments that exceeded the 15% threshold. The county challenged this order in court, but a Jackson County Circuit Court judge ruled in favor of the STC, affirming its authority to mandate such rollbacks

County Executive’s Veto and Legislative Response

In April 2025, the Jackson County Legislature passed an ordinance directing compliance with the STC’s rollback order. County Executive Frank White vetoed this ordinance, citing concerns over potential financial impacts on schools and public services. An attempt by the legislature to override the veto failed to achieve the necessary six-vote majority .

Ongoing Disputes and Calls for Investigation

Following the failed override, a group of county legislators requested the Missouri Attorney General to investigate White’s actions, alleging violations of state law and fiscal mismanagement . Additionally, a recall effort against White has gained momentum, with organizers submitting signatures to place the measure on the ballot .

Implications for 2025 Assessments

The STC has issued a new order requiring Jackson County to correct the 2023 and 2024 assessment rolls to ensure accurate baselines for the 2025 assessments. White has expressed opposition to this order, arguing that it contradicts previous court decisions and could lead to instability in the assessment process .