If you are out in the market doing deals . . . or talking to people you have probably made note that the Real Estate Market has Shifted.

One of the reasons to stay connected to others and talk to people is so you are not out there doing deals like it was 2022, when in fact we are hearing about price reductions. BIG ONES!

My first indication of a shift was a post in our Facebook Group about a House in Waldo. The house was nice and updated, and the seller had another house he wanted to buy under a contingent contract. And that contingency was running out. The loan was assumable and the seller was willing to buy down the interest rate. The price had dropped $40,000. But I thought perhaps this was an anomaly. I mean we had just came off the election, which typically slows down sales. We are heading into Thanksgiving week, a time when sales traditionally slow down. And the seller was highly motivated because he wanted to buy a new house.

Then my friend Vena Jones-Cox, a counterpart in Ohio, shared a couple of posts. She had just came out of a giant 4 day convention with 1000 of investors from across the nation.

Something I heard over and over in the halls at Oreia’s National Real Estate Strategies Summit: “I have a really nice rehab on the market, and it’s not moving.” Heard this from multiple people in multiple markets. (Link to Post)

Although the stats aren’t out yet, there seems to be general agreement that the market has slowed down a lot in the last few months.

I’ve talked to a fair number of panicked retailers, hard money lenders, and agents in the past couple of weeks–“We’ve cut the price to the bone, and still no serious offers!!” (Link to Post)

As I approve postings of properties in the group I am seeing “PRICE DROP” “PRICE IMPROVEMENT” and I am seeing these be between $20,000 up to $40,000. One person posted the house should have easily sold for $450,000, but instead is sitting on the market at I $367,000.

I wanted to see what was happening with everyone – right here in the Kansas City Market so I asked on Facebook (Link to the Post so you can join the conversation.)

Keep in mind these are discussions in a Facebook group and may not have the right spelling and grammar.

From Travis Moore: Fewer buyers with fewer showings. But still ok, for now…Right condition/price, acreage, popular areas, etc still going ok. Problem is buyers and realtors do not understand why Fed dropped .5 the end of summer and again now, BUT mortgage rates have risen. It was pretty easy to see coming. Mortgage rates are NOT directly tied to the Fed prime rate. But, most buyers are still sitting trying to time markets and scratching their heads. If we actually continue and fall flat in the spring, it is the system and people, not who is in office. I hope confidence hits and spring propels us, but I am worried that word recession, everyone kept saying would happen three years ago, will start to happen. I hope not. The market was way too hot after covid too have a recession. Some of us knew that going in. The 1% knew that. The stock market skyrocketing is usually a foreshadow……

From Sheldon Oots: Depends on area of course but generally speaking I’m seeing a slow down w extended days on market and lots of price decreases.

From Jonathan Trimble: Showings down across the board. I mean they picked up over the last 2 weeks but definitely not what it was this time last year or over the summer. To me it feels like buyers out there are looking for a “deal”, throwing in super low offers on properties sitting past 45 days. DOM is definitely up, and I’m hitting price reductions on my listing and investors listings to try to get inventory gone. I think the properties going quick are listing below what they would have a few months ago to get it gone. Those are the properties I’m seeing go pending.

From Shane Pascoe: Showings have been lower than a few months ago, but multiple offers within 3 days of listing in Lee’s Summit. With lower showings what do you feel is the biggest factor to sell – Price, Location, Value (size, amenities, layout of house), Quality of rehab (not the same rehab house that you see across the board with Whites, Greys and Home Depot material), Uniqueness?

From Dean DeBitetto: Over the past week we have seen price decreases affecting about 10% or so of the residential listings. Yesterday we were sitting with over 6,700 listings and under contract are slightly outpacing new on market/back on market for the week

From Jeff Crawford: Im seeing alot of inventory that is overpriced. Terrible flips, lackluster finishes, or alot of updating still necessary- coupled with sellers shooting for the stars on list price. In my mind, those details skew DOM and price reduction metrics! Obviously many variables play in, but those have been standing out to me.

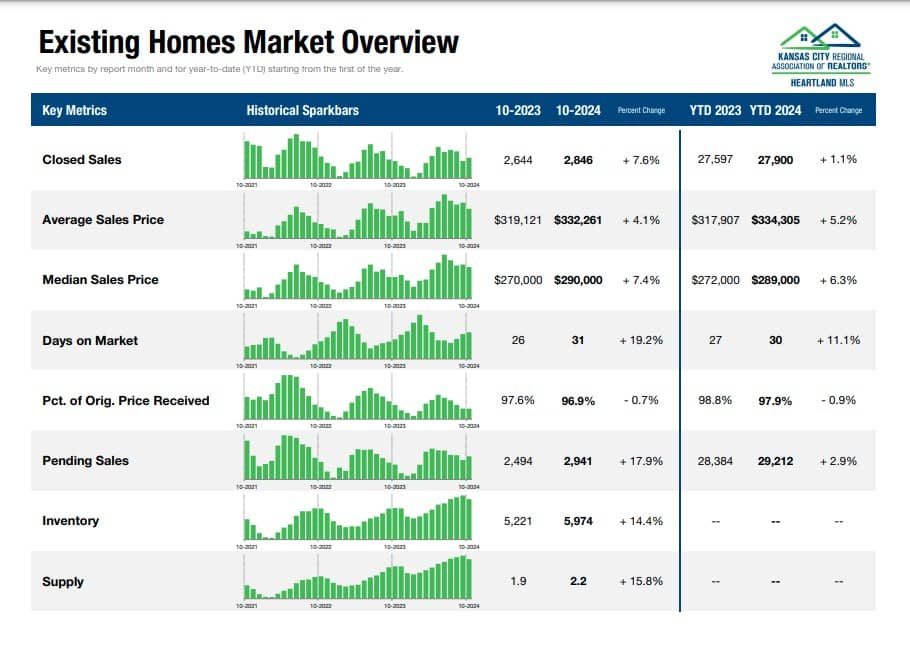

I missed out on the discussion that happens at the WinVestor’s meeting every week, but I know last week they were seeing a shift. And if you hit up KCRAR our DOM, Inventory and Days Supply are all up. The Percent of List price is down. And I noted on Kyles HouseGraphs.com that there is a new state coming – Price Improvements.

We would love to get your feedback on what you see happening. You can comment here on the post if you scroll down or you can join the conversation in our Facebook Group.