Groundfloor first came to my attention in January of 2022. I watched a virtual meeting of National REIA with several different alternative investment platforms. At the time, finding real estate investment deals was tough and they were presenting other ways to put your money to work besides fixing and flipping or being a housing provider. I probably would not have taken much notice, but the next week, Groundfloor joined MAREI as a business member. They came to our meetings regularly, mostly to offer hard money loans to our members. They did a few loans in the KC Metro, and then they stopped attending.

I looked a little closer at their website to learn more about their alternative investment offering where I could buy into one of their hard money loans. But unlike some of the other hard money lenders where they make the loan and will sell you the whole note, Groundfloor will sell you a fraction of the note. This made it very attractive to me. I could invest a spare $10, $50, or $100 into a loan and earn at that time 8 to 10%. Now in 2024, those interest rates are quite a bit higher. Or I could invest $5,000 in to 5 loans, or 10 loans.

It looked interesting to me, so I signed up.

. . . Who am I Kim Tucker one of the founders of MAREI, Don my partner in real estate and life joined me for our trial run.

What is Groundfloor

What are they? They are a hard money lender, and when I introduced them once I said they were a crowdfunding source and they were quick to tell me that is not what they are.

If you look it up on their website they tell you that they are an originator of short-term, high interest rate real estate loans. Then they “fractionalize” those loans so that anyone can buy as little as $10 in a fraction of the loan. Their website says $1, but you must invest in increments of $10.

You can read the full What is Groundfloor page on their website. For the type of investments I have experience with, it works like this. They originate the loan charging points and interest. They are keeping all the points and all the interest except for the interest they pay out on the fractional portions of the loans sold to you and me. We get the interest on those fractions.

Read all the way to the end to find out how to get $50 in FREE Money from Groundfloor

Complete Your Due Diligence on Groundfloor

Before we go further, let me remind you that in all things YOU need to complete your own Due Diligence. What works for me may not work for you and my risk tolerance might be different. There are a lot of favorable articles on the internet. And they have links to many of their SEC filings on their website. Although they only go up to about 2021, after that you will need to look things up on www.SEC.gov.

My Results with Groundfloor

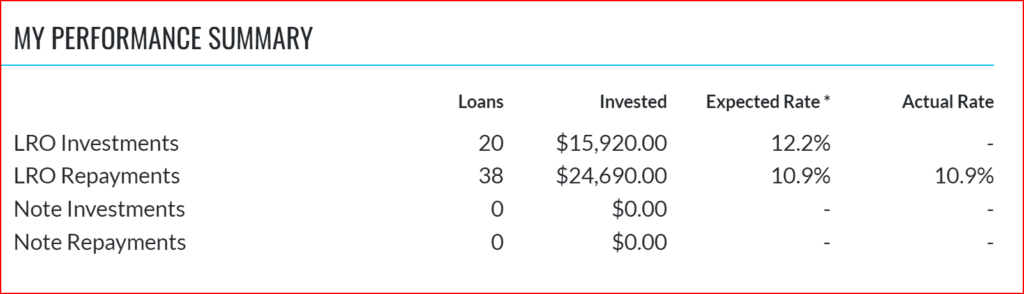

After those two chance encounters in January of 2022, I invested a whopping $1,000 with them. By June I had 3 loans. And now in early 2024. I have about $15,000 invested with them. Over the past 2 years I have lent out $24,690 in a series of 38 loans. My expected rate of return was 10.9% and that was my actual rate.

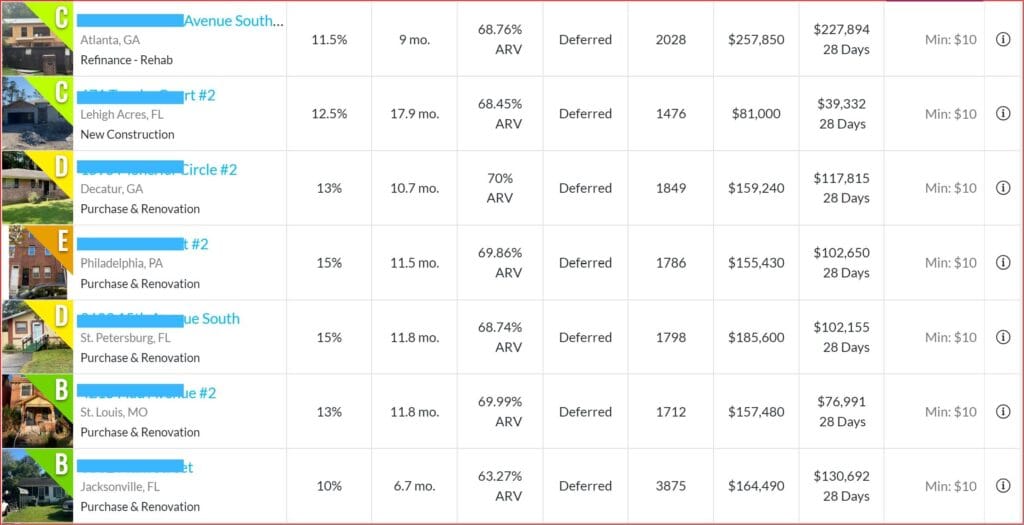

Some Sample Loans from the Platform are below. I attempted to log into the website to make a cool video. But because we should not be divulging the loan information borrowers online, we could not create anything that worked. Suffice it to say there are A, B, C, D, and E Loans. They are in about 8 to 10 states with interest rates range between 10% and 15%.

Below is just a small snap shot with the addresses covered up.

You can dive into each loan and see skin basic borrower information, how much the borrower has invested, the loan to value, borrower’s plans, some valuation reports, and some of the borrower’s experience.

Originally I looked at all these details loan after loan. I was looking for bread and butter houses with a Median Price for ARV. In nice areas, you know houses you would buy to rehab if you were in that area. But that took a lot of time. But still, I was investing $500 a loan and I wanted to get the best one, in a nice area, that I thought the borrower could sell easily, and in states with fast foreclosure laws.

They have some automated investing tools where you tell it your risk tolerance and you trust them to put the money in good loans.

I have a new strategy, more on that in a minute.

My Returns

All of my loans have performed at the rate of return listed. A few took longer than advertised to pay as there was a time in late 2021 early 2022 when there was a huge issue in getting materials, hiring contractors, and getting the renovations completed. A few took a few extra months. Those off paid, just a few months late and I still got my interest.

We currently have one that is in foreclosure. We had a couple of others they threatened foreclosure, but then they sold or refinanced and the talk of foreclosure was no longer needed. It seems to me they work the way most good hard money lenders work. They make the loans with the plan for the borrower to succeed. And if the borrower has a bit of a rough patch, they work with them just a bit to get them to success rather than rushing quickly to foreclosure. But maybe that’s wrong. Not sure.

When I started in 2022, the average interest rate was around 8%. Right now mid 2024 the average interest rate on a B or C grade loan is around 10%. But I have invested in a few of the 11%, 12%, 13% and just last week I put some money on a 15% interest rate loan. Average all of those that have paid off together and my rate of return has been 10.9%.

My initial strategy was to put $500 to $1000 in a loan that looked good on paper. All the right ARVs, Loan to Values, Skin in the Game and Bread and Butter Houses. I was trying to get a decent rate as close to 10% as I could get, and have it invested for the life of the loan.

Plus I want to turn them fast when they pay off. Every time they pay off a loan, I get an email notification usually a day or two later. So the money comes back and earn nothing for 2 days. So ideally keeping it invested in a longer term loan, you don’t have to spend time picking the ideal loan.

But I am trying something new.

My New Investment Strategy

About 6 months ago I was trying to justify those D and E loans at 13% at the time, now at 15%. I started Googling Address to see if any might be finished or to see photos. Whatever I could learn about the house and the area.

I stumbled on quite a few that were all rehabbed and listed for sale. Done . . . Finito . . . all they needed to do was find a buyer, get through the closing process and bam I get paid back. No worrying that they brand new investor borrower with that D or E loan was going to get it rehabbed.

I started putting $500 here and there into already renovated and listed D and E loans in Georgia. I like Georgia because they have a fast foreclosure just like Missouri. And guess what, they seem to be paying off in 2 weeks to 2 months. And I am earning higher interest rates for shorter periods. But I can turn in a loan in about 10 minutes once I am notified it is paid off.

And because of the short term, I can reinvest at future higher interest rates. If these start going back down, then I would want to invest for longer to lock in the higher rates for longer periods.

So for now, I am locking in 14% to 15%.

How to Get Free Money from Groundfloor

Like many financial online platforms, they have a referral program. How it works is that I as a current user have a referral link: https://app.groundfloor.us/r/aa6de4 when you set up your account and invest, currently $100, they will give you $50 in free money. (They will give me $50 in free money too)

Steps

- Click the link and set up your account https://app.groundfloor.us/r/aa6de4

- Then connect your Groundfloor account to your bank account

- Transfer $100 into Groundfloor

- Invest it . . .and in about 30 days they will deposit $50 in free money into your account.

- They will also deposit $50 in free money into my account.

What is Your Risk Tolerance

For me, to invest $100 is not overly risky so I took the leap and did it in an afternoon.

Sure Groundfloor could go belly up, all those reports they have filed with the SEC show they are not profitable., but then there are other companies that are great investments yet not profitable according to people smarter than I.

And while THEY own a 1st Position Lien on a house, you will not, you will own a fraction of it. They can foreclose on behalf of all the fractional owners, but I highly doubt you could do so owning only a small fraction of the loan. Your name is not on the note.

What I do know is that they have been in business since 2011.

They do have a lot of people investing with them. They are making loans that are in first position secured by real estate with a loan to value under 70%. My biggest risk is that they go belly up and while they get paid off, they fail in their promise to pay me. I doubt that will happen, but I guess it could.

I am not going to put all my eggs in their basket. But to invest $100 to get $50 and then a bit more to make a 10 to 15% return on a small dollar loan. I am going to keep going with my $15,000. I might add a few extra dollars to it from time to time rather than going out for dinner.