Have you ever sat down and considered all the ways you can make money with just one single-family house? I had read the articles and seen the different benefits. I had never truly gone through an average house and put it all down on paper.

Buying to Flip, Can Turn a Great Profit

Mostly, Don and I have wholesaled our houses. Sometimes this yielded a few thousand dollars in profit. There were the little townhouses we bought with tenants for $28,000 way back in the day using cash. We rented them out and pocketed $1,400 a month in rent for several months. Then we found someone willing to take on the headache of these problematic properties for $30,000 each. I figured out what we made on these in a lump sum:

- $1,400 each for about 7 months = $9,800

- Depreciation for 7 months (recaptured when we sold) = $0

- Profit on sale = $4,000

- Total profit = $13,800, which was straight income into our company

- No other fancy deductions

- We sold these to Eric Grannemann (our speaker this month, by the way)

Sure, there were some incredible deals where we did nothing and made significant profits. We used this to buy more properties, make necessary fixes, and sell for substantial profits ranging from $20,000 to $120,000. Really.

Now, if we were proficient at short sales, like David Randolph from St. Louis, we would be making $50,000 to $150,000 in profit on every house we bought and sold.

Buy and Hold Properties are the Bomb

But it wasn’t until that Saturday workshop with John Burley—and, more importantly, when I was listening to an audio segment from his training course—that the light bulb finally went off for me. Sure, Don and I have sold a few houses on a lease with an option to purchase. For the most part, every one of those deals worked as they were supposed to. But we didn’t do enough of them.

We bought properties, including a few brand-new houses, and others, like one that had a tree through the roof for months before the bank finally auctioned it off to us, which needed extensive work. The buyer paid an option fee, leased the property from us, and received rent credits. I assume we got tax benefits, though our bookkeeper and CPA handled that. Eventually, the buyer secured a loan and paid us off. It worked exactly like John Burley said it would.

If you weren’t there, let me explain: the John Burley model involves raising private capital from a partner, with whom he splits everything in exchange for their cash and sometimes their credit. He buys an average house in a typical B-class neighborhood—think median price—that doesn’t need extensive repairs. He then sells it on a lease with an option to purchase, commanding a premium price and rent. The buyer has ten years to complete the purchase.

During his Saturday class and in his training materials, he shared the sales pitch he uses when speaking to potential capital partners. While he doesn’t give a typical real estate seminar, he does walk them through the numbers to illustrate the returns on an average house, so they can compare it to what they might earn from the bank or stock market.

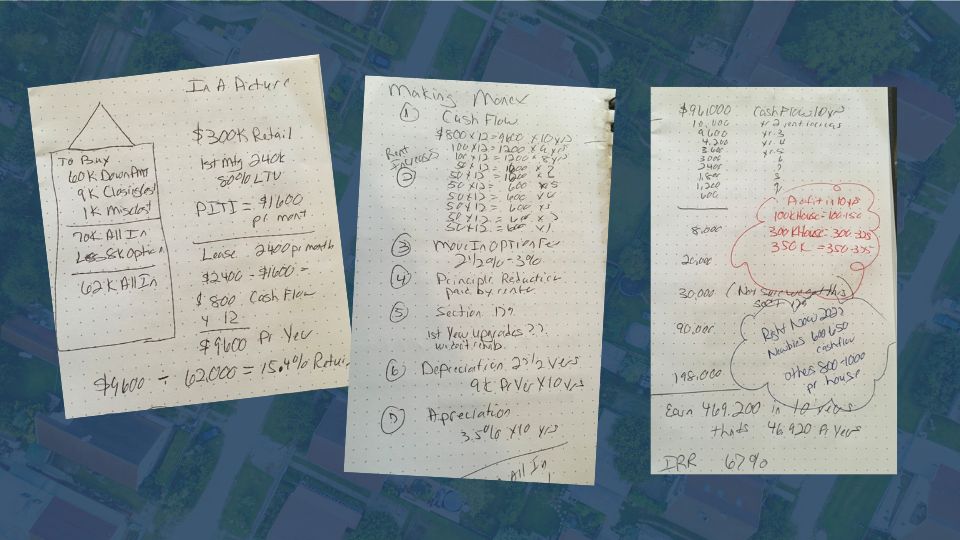

Here are my notes from that Saturday:

This first page is just an overview of the cash flow if the property were purchased with a bank loan. The cash flow is the difference between the $2,400 monthly lease payment and the $1,600 he pays for principal, interest, taxes, and insurance.

Note that he pays interest to his capital investor if they fund the entire deal, typically at a rate of 3% to 4%. Alternatively, he pays the prevailing interest rate to the bank if the capital investor only provides the down payment. The capital investor contributes additional funds to cover working capital and reserves.

In this example, the capital investor provided the down payment. In the first year, their cash flow would be $9,600.

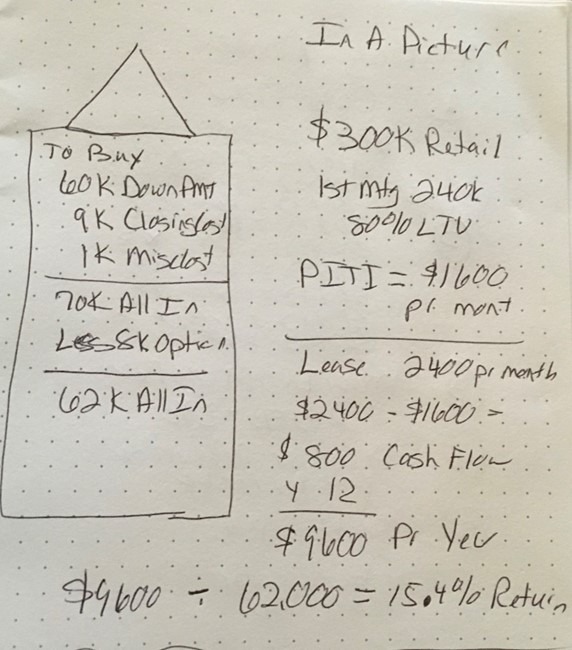

Now this is where things start to get interesting.

(Note that some of my numbers in the picture below were wrong, I was writing fast as I took notes and didn’t get them written down correctly.)

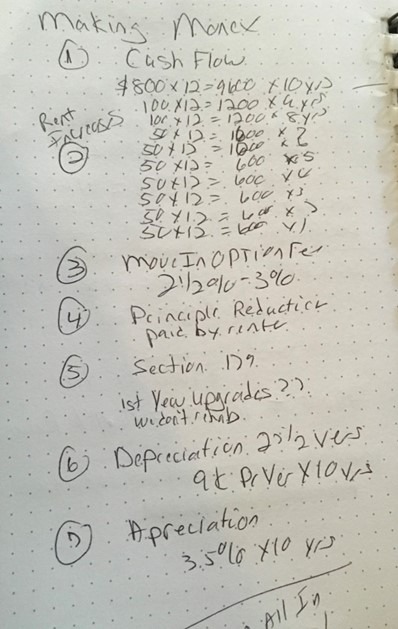

Cash flow is what we just went through $800 a month for 12 months to earn $9,600 the first year, but in 10 years, that adds up to $96,000

These are the annual rent increases each year added on

o Year 2: $100 Increase x 12 months = $1,200 for 9 years = $10,800

o Year 3: $100 Increase x 12 months = $1,200 for 8 years = $9,600

o Year 4: $50 Increase x 12 months = $600 for 7 years = $4,200

o Year 5: $50 Increase x 12 months = $600 for 6 years = $3,600

o Year 6: $50 Increase x 12 months = $600 for 5 years = $3,000

o Year 7: $50 Increase x 12 months = $600 for 4 years = $2,400

o Year 8: $50 Increase x 12 months = $600 for 3 years = $1,800

o Year 9: $50 Increase x 12 months = $600 for 2 years = $1,200

o Year 10: $50 Increase x 12 months = $600 for 1 year = $600

Total Profit from just rent increases: $37,200

Option Fee of 2.5% to 3% of Purchase Price: $8,000

Principal Reduction – the paydown of the mortgage by the renter: $20,000 (sorry, I don’t have the exact math on this one)

Section 179 of the Tax Code allows you to deduct certain capital improvements in a house—either new installations or improvements that are “new to you” because you just bought the property. This is something I need to run by my CPA, but John B’s CPA swears by it. He typically deducts 8% to 10% of the purchase price on every house, which for this example was $30,000 (10% of a $300,000 house).

Depreciation is standard and mandatory on every rental house and works out to about $9,000 per year over 10 years, totaling $90,000. While it’s not income, it serves as a deduction that can be used to offset other income and reduce your taxes.

Appreciation refers to the increase in the value of houses over time. For this example, John B used a 3.5% annual appreciation rate over 10 years, which amounts to $198,000.

Adding it all up gives you $379,200 in dollar value, plus another $90,000 in depreciation to offset your taxes. Altogether, you have $469,200. We didn’t do the exact math here, but it equates to an Internal Rate of Return (IRR) of 67%.

When the lease option buyer is ready to sell and you have accumulated significant equity, you don’t cash it out, trigger a recapture of depreciation, and pay huge taxes. Instead, you use a 1031 Exchange to roll that equity into a new, larger property. You could almost buy the next property outright or use it as a down payment on several new properties, repeating the process.

And many of us are busy wholesaling and fixing and flipping houses for quick cash…why? I’d wager this is something we’re going to learn more about from Eric Granneman this November at MAREI. He primarily focuses on buy and hold investing, though I know he enjoys buying distressed properties, fixing them, renting them out, leveraging all the benefits we’ve discussed, and then 1031-exchanging them into something even bigger.

Hope to see you at the meeting! Members, if you missed John Burley or David Randolph, we have their replays available in the library. And if you would like to learn more about John Burley’s business model beyond the replay in the member library, get with me – kimatmarei@gmail.com I can get you the Saturday class, probably Johns Training Course he sold . . . and Don can walk you through the numbers.